A company has to pay its office rent and utility bills every month regardless of whether it produces 1,000 products or no products at all, for example. Direct costing assigns the direct costs of producing a good or service to that product, while absorption costing assigns all production costs, including indirect costs, to a product. In management in a process costing system the number of wip inventories accounting, product costs are incurred in producing a good or service. Tracking and managing product costs is essential to ensure a company remains profitable. The preceding illustration highlights a common problem faced by many businesses. As time nears for a scheduled departure, unsold seats represent lost revenue opportunities.

Absorption and Variable Costing Problems and Solutions

On the other hand, if you’re in a service-based industry, variable costing may make more sense. Materials, such as raw materials and supplies, can also be considered variable costs. However, in 2018, the company produced 1,000,000 phone cases, with total manufacturing costs of $598,000 (approximately $0.60 per phone case).

Advantages of Absorption Costing

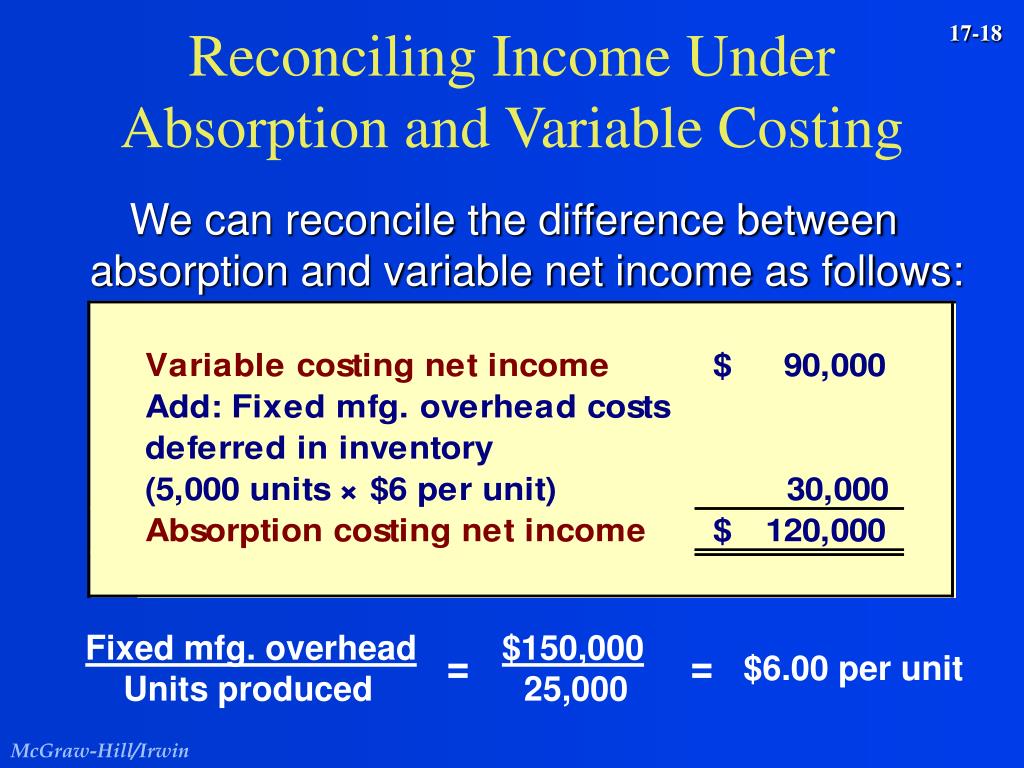

- Under absorption costing, the amount of fixed overhead in each unit is $1.20 ($12,000/10,000 units); variable costing does not include any fixed overhead as part of the cost of the product.

- If every transaction were priced to cover only variable cost, the entity would quickly go broke.

- Absorption costing includes a company’s fixed costs of operation, such as salaries, facility rental, and utility bills.

- Ultimately, the best method of accounting for product costs depends on the company’s specific needs.

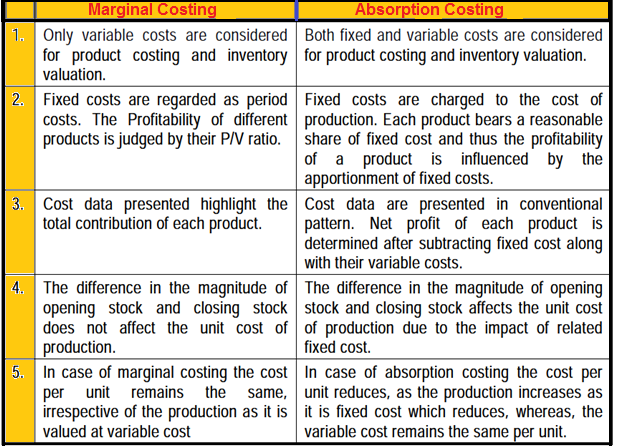

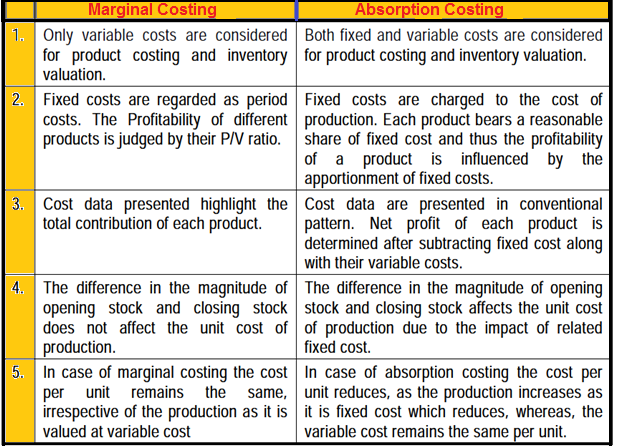

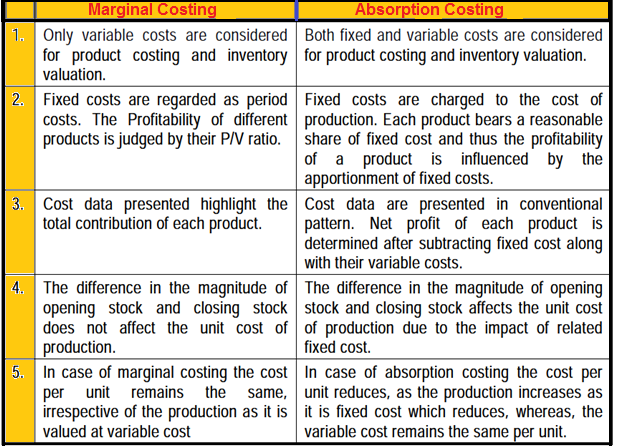

- While both methods aim to calculate the cost of producing goods or services, they differ in their approach to allocating fixed manufacturing overhead costs.

Under the absorption costing method, all costs of production, whether fixed or variable, are considered product costs. This means that absorption costing allocates a portion of fixed manufacturing overhead to each product. Absorption costing includes all costs, including fixed costs, related to production, while variable costing only includes the variable costs directly incurred in production. Companies that use variable costing keep fixed-cost operating expenses separate from production costs.

Accounting for All Production Costs

Overall, variable costing is a way of allocating expenses between fixed and variable costs. Businesses often use this method to help manage their finances and decide where to allocate their resources. Examples of standard variable costs include wages, rent, utilities, and materials.

From gross profit, variable and fixed selling, general, and administrative costs are subtracted to arrive at net income. It is the presentation that is typical of financial statements generated for general use by shareholders and other persons external to the daily operations of a business. In the previous example, the fixed overhead cost per unit is \(\$1.20\) based on an activity of \(10,000\) units. If the company estimated \(12,000\) units, the fixed overhead cost per unit would decrease to \(\$1\) per unit. Variable costing, also known as direct costing, only includes variable production costs in determining the cost of a product. Fixed overhead costs are treated as period costs and expensed in the period incurred rather than allocated to units produced.

One of the key differences between absorption costing and variable costing lies in the allocation of fixed manufacturing overhead costs. Absorption costing allocates these costs to units of production, regardless of whether they are sold or remain in inventory. This means that fixed manufacturing overhead costs are included in the cost of each unit produced, whether it is sold or not. As a result, absorption costing tends to have higher per-unit costs compared to variable costing.

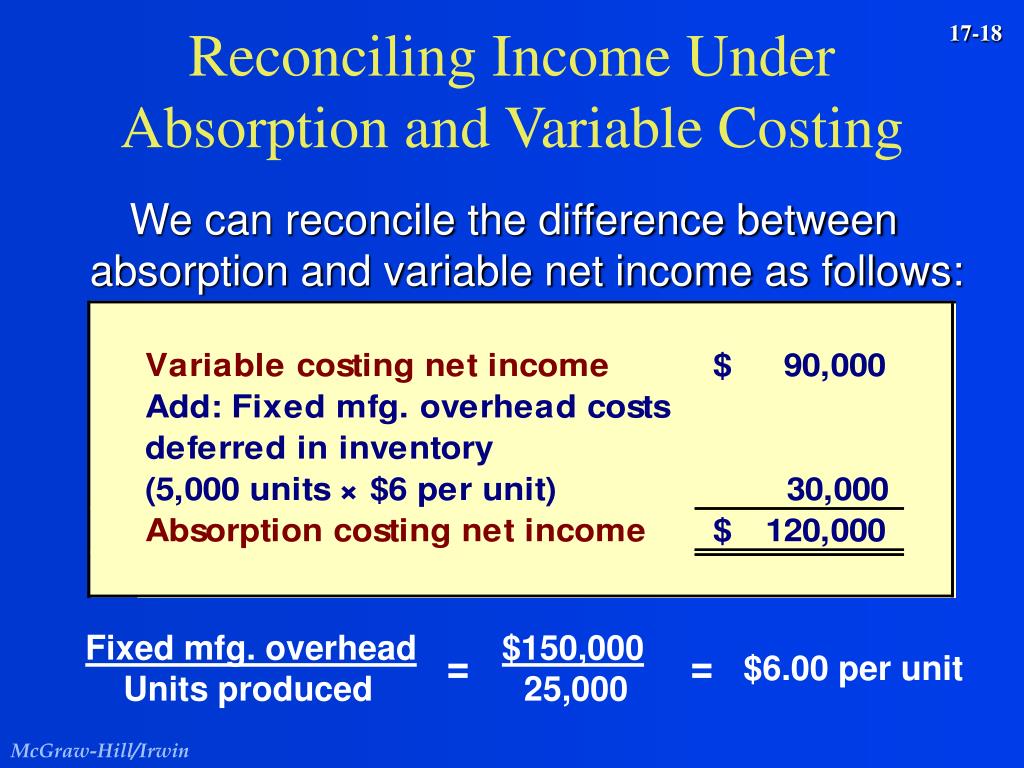

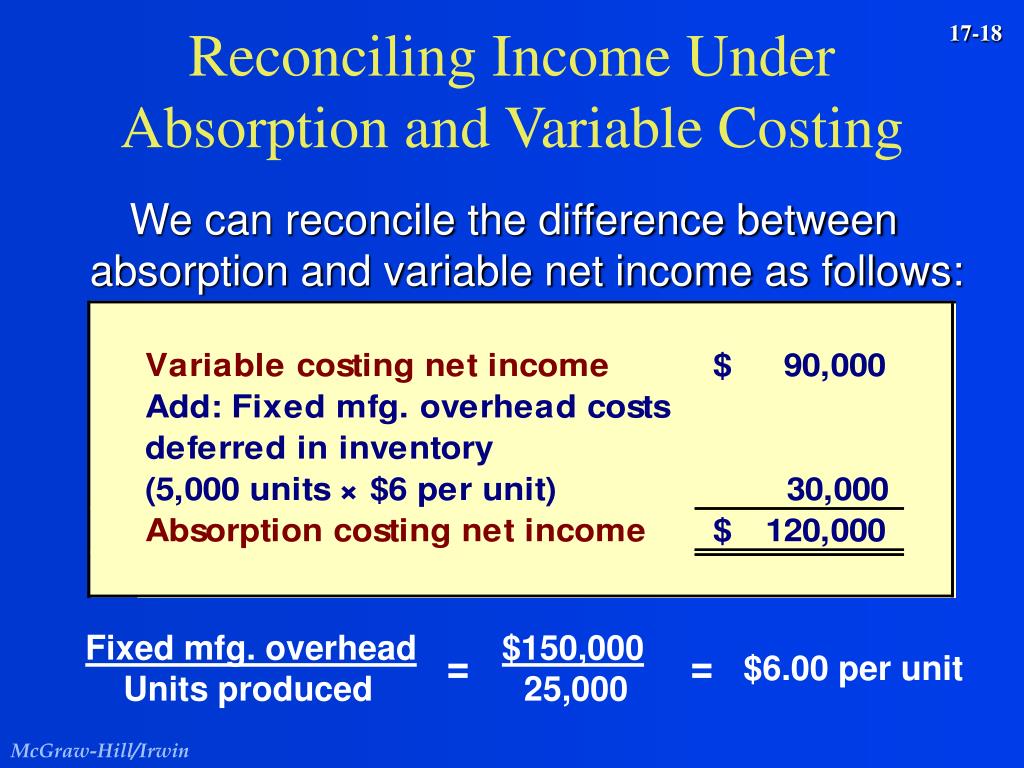

The choice of costing method can impact the valuation of inventory and the measurement of net income. Variable costing provides a better view of marginal profitability, while absorption costing adheres more closely to GAAP and matches all production costs against revenue. As a general rule, relate the difference in net income under absorption costing and variable costing to the change in inventories. Conversely, if inventories decreased, then sales exceeded production, and income before income taxes is larger under variable costing than under absorption costing.

Therefore, the methods can be reconciled with each other, as shown in Figure 6.17. Therefore, the methods can be reconciled with each other, as shown in Figure 8.1.7. The difference in the methods is that management will prefer one method over the other for internal decision-making purposes.

The manufacturer only considers variable manufacturing costs to ease cost control. Higher inventory values lead to lower cost of goods sold and higher gross margins as a percentage of revenue. As such, absorption costing results can make operational performance seem better. Careful analysis of cost behavior is needed when comparing income figures between variable and absorption costing.

Variable costing provides useful information for management decisions related to pricing, product mix optimization, and incremental analysis. Variable costing isn’t allowed for external reporting because it doesn’t follow the GAAP matching principle. It fails to recognize certain inventory costs in the same period in which revenue is generated by the expenses.